Kyndryl Complaint Overview

The Kyndryl class action lawsuit asserts securities fraud claims under Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 on behalf of investors in Kyndryl securities. The class action is pending in the U.S. District Court for the Eastern District of New York. It is captioned Brander v. Kyndryl Holdings, Inc., et al., No. 1:26-cv-00782.

If you lost money on your Kyndryl investment, you are encouraged to submit your information using the form on this page. You may also email adam@bfalaw.com or call 212.789.3619.

Why Is Kyndryl being Sued for Securities Fraud?

Kyndryl Holdings, Inc. has been sued for securities fraud following a significant stock drop resulting from potential violations of the federal securities laws. The decline in Kyndryl’s stock price caused significant losses to investors.

Kyndryl is a provider of enterprise technology services offering advisory, implementation and managed service capabilities to customers in more than 60 countries. Kyndryl is the world’s largest IT infrastructure services provider.

As alleged, Kyndryl misrepresented its cash management practices, including the drivers of its adjusted free cash flow metric, and the efficacy of Kyndryl’s internal controls over financial reporting for FY2025 and the first three quarters of FY2026.

Why did Kyndryl’s Stock Drop?

On February 9, 2026, Kyndryl announced that it would delay the release of its fiscal Q3 2026 financial statement pending an accounting review into its cash management practices and related disclosures, including regarding the drivers of the Company’s adjusted free cash flow metric, and certain other matters following document requests from the SEC. Kyndryl also announced the immediate departures of its CFO and General Counsel.

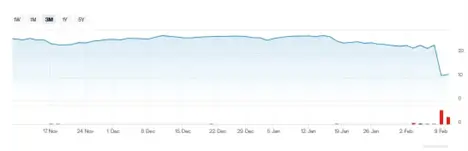

On this news, the price of Kyndryl stock dropped over 52% during the course of trading on February 9, 2026.

Kyndryl (KD) Stock Chart

NYSE online chart showing the Kyndryl (KD) stock drop following the February 2026 announcements.

What is the Kyndryl Leadership Deadline?

You may ask the Court no later than April 13, 2026, to appoint you as Lead Plaintiff through counsel of your choice.

To be a member of the Class, you need not take any action at this time. The ability to share in any potential future recovery is not dependent on serving as Lead Plaintiff.

How Do I Submit My Information for the Kyndryl Class Action?

If you lost money when Kyndryl securities dropped in price, you are encouraged to submit your information using the form on this page to speak with an attorney about your rights.

You can also contact:

Adam McCall

amccall@bfalaw.com

212.789.3619

All representation is on a contingency fee basis; there is no cost to you. Shareholders are not responsible for any court costs or expenses of any class action lawsuit. The firm will seek court approval for any potential fees and expenses.

Why Bleichmar Fonti & Auld LLP?

BFA is a leading international law firm representing plaintiffs in securities class actions and shareholder litigation. It has been named a top plaintiff law firm by Chambers USA, The Legal 500, and ISS SCAS.

BFA attorneys have been named “Elite Trial Lawyers” by the National Law Journal, “Litigation Stars” by Benchmark Litigation, among the top “500 Leading Plaintiff Financial Lawyers” by Lawdragon, “Titans of the Plaintiffs’ Bar” by Law360, and “SuperLawyers” by Thomson Reuters.

BFA’s notable successes include a recovery of over $900 million in value from Tesla, Inc.'s Board of Directors, as well as $420 million from Teva Pharmaceutical Ind. Ltd.

Attorney advertising. Past results do not guarantee future outcomes.