Synopsys Class Action Lawsuit Overview

The class action lawsuit asserts securities fraud claims under Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 on behalf of investors in Synopsys securities. The first-filed class action is pending in the U.S. District Court for the Northern District of California. It is captioned Kim v. Synopsys, Inc., et al., No. 3:25-cv-09410.

If you lost money on your Synopsys investment, you are encouraged to submit your information using the form on this page. You may also email ross@bfalaw.com or call 212.789.3619.

Why is Synopsys Being Sued for Securities Fraud?

Synopsys, Inc. has been sued for securities fraud following a significant stock drop resulting from potential violations of the federal securities laws. The decline in Synopsys’s stock price caused significant losses to investors.

Synopsys provides design automation software products used to design and test integrated circuits. The Company’s Design IP segment, which provides pre-designed silicon components to semiconductor companies, has been the Company’s fastest-growing segment, growing from 25% of its revenue in 2022, to 31% in 2024.

During the relevant period, Synopsys told investors that its customers “rely on Synopsys IP to minimize integration risk and speed time to market” and that it was seeing “strength in Europe and South Korea.” Synopsys also stated it was “continuing to develop and deploy[] AI into our products and the operations of our business.”

As alleged, in truth, the Company’s Design IP customers began to require additional customization for IP components, which was deteriorating the economics of its Design IP business and jeopardizing its business model.

Why did Synopsys’s Stock Drop?

On September 9, 2025, Synopsys released its Q3 2025 financial results, revealing its “IP business underperformed expectations.” The Company reported revenue for its Design IP segment of $425.9 million, a 7.7% decline year-over-year and net income of $242.5 million, a 43% year-over-year decline.

The Company also revealed that its Design IP customers require “more and more customization,” which “takes longer” and requires “more resources.” As a result, the Company stated it was having “an ongoing dialogue with our customers” regarding changing its business model.

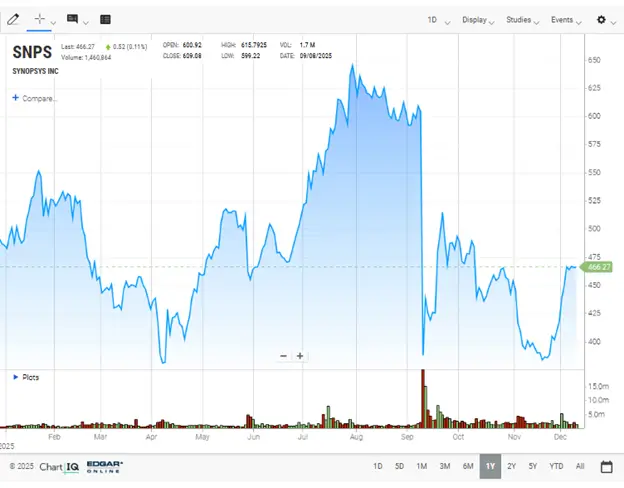

This news caused the price of Synopsys stock to fall $217.59 per share, or nearly 36%, from $604.37 per share on September 9, 2025, to $387.78 per share on September 10, 2025.

Synopsys Class (SNPS) Stock Chart

NASDAQ online chart showing the Synopsys (SNPS) stock drop following the September 2025 announcement.

What is the Synopsys Leadership Deadline?

You may ask the Court no later than December 30, 2025, to appoint you as Lead Plaintiff through counsel of your choice.

To be a member of the Class, you need not take any action at this time. The ability to share in any potential future recovery is not dependent on serving as Lead Plaintiff.

How Do I Submit My Information?

If you lost money when Synopsys securities dropped in price, you are encouraged to submit your information using the form on this page to speak with an attorney about your rights.

You can also contact:

Ross Shikowitz

ross@bfalaw.com

212.789.3619

All representation is on a contingency fee basis; there is no cost to you. Shareholders are not responsible for any court costs or expenses of the class action lawsuit. The firm will seek court approval for any potential fees and expenses.

Why Bleichmar Fonti & Auld LLP?

BFA is a leading international law firm representing plaintiffs in securities class actions and shareholder litigation. It has been named a top plaintiff law firm by Chambers USA, The Legal 500, and ISS SCAS.

BFA attorneys have been named “Elite Trial Lawyers” by the National Law Journal, among the top “500 Leading Plaintiff Financial Lawyers” by Lawdragon, “Titans of the Plaintiffs’ Bar” by Law360 and “SuperLawyers” by Thomson Reuters.

BFA’s notable successes include a recovery of over $900 million in value from Tesla, Inc.’s Board of Directors, as well as $420 million from Teva Pharmaceutical Ind. Ltd.

Attorney advertising. Past results do not guarantee future outcomes.